ohio sales tax exemption form reasons

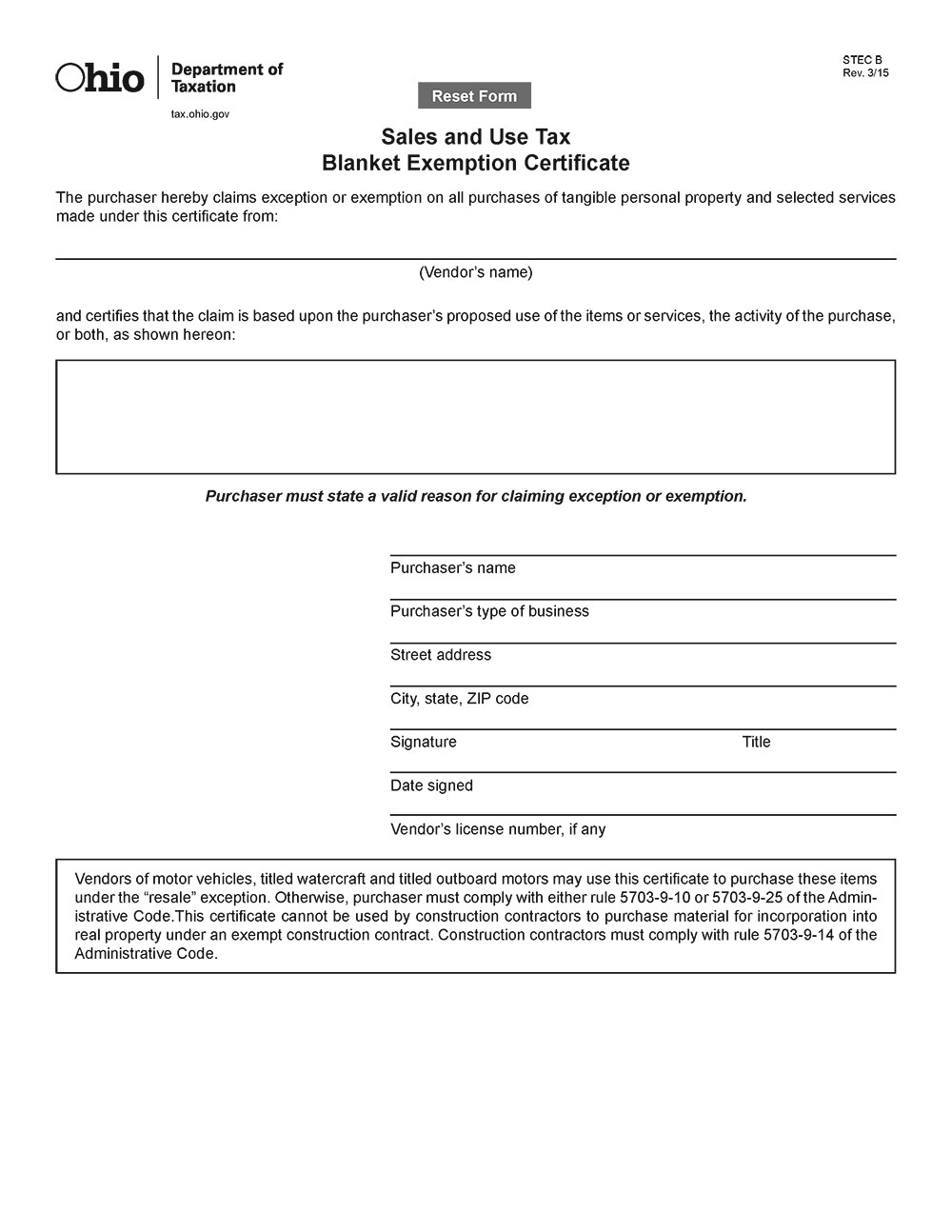

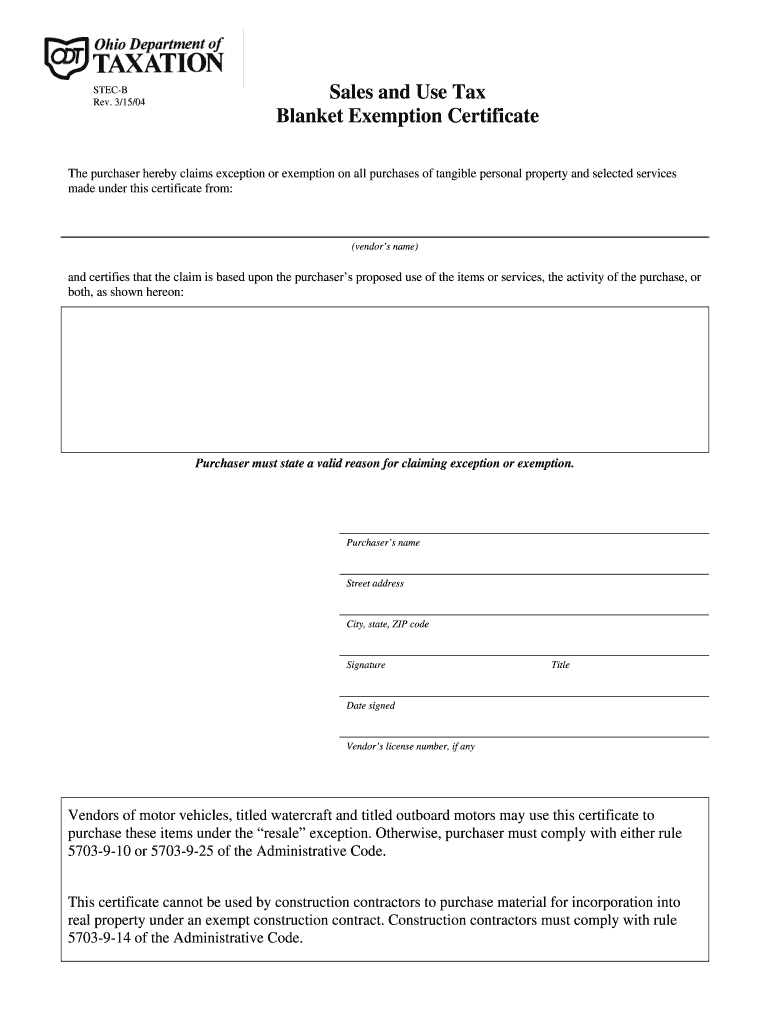

Ad Access Tax Forms. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors.

Ohio Tax Exempt Form Holland Computers Inc

These forms may be downloaded on this page.

. The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. Tax-exempt items and services include. Sales and Use Tax Blanket Exemption Certificate.

Reasons for Tax Exemption in Ohio Sales and Use Tax. The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. Those are the reasons for our newest law bulletin Ohios Agricultural Sales Tax Exemption Laws.

Its a hidden cost. 1 If a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming exemption from the sales and use tax based on a reason other than resale the vendor seller or consumer must comply with rule 5703-9-10 or 5703-9-25 o. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from.

Most services from snowplowing to manicures are exempt from sales tax. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and.

In addition to requiring purchaser information such as name address and business type Ohio. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Integrate Vertex seamlessly to the systems you already use. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. Counties and regional transit.

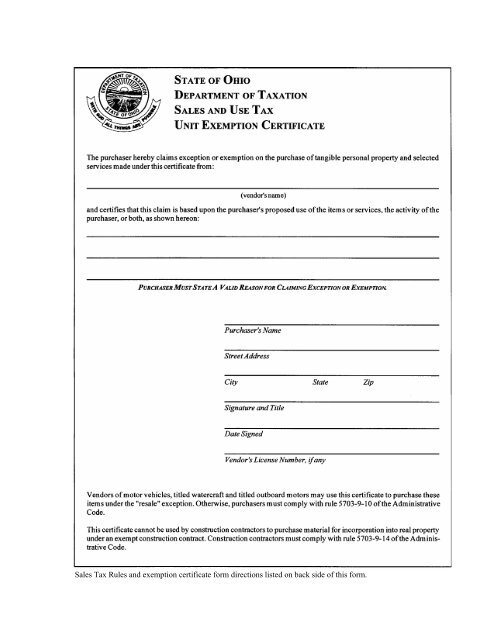

We walk through the different sales tax exemptions that apply to agriculture offer examples of goods that do and do not qualify for the exemptions explain who can claim an exemption and how to claim it and explain what happens when sales taxes are overpaid or not. The Unit Exemption Certificate is utilized for the majority of tax exempt purchasing procedures and the Blanket Exemption Certificate is the blanket version of this form. Complete Edit or Print Tax Forms Instantly.

The state sales and use tax rate is 575 percent. Ad New State Sales Tax Registration. Sales tax can be scary especially when youre just starting your business.

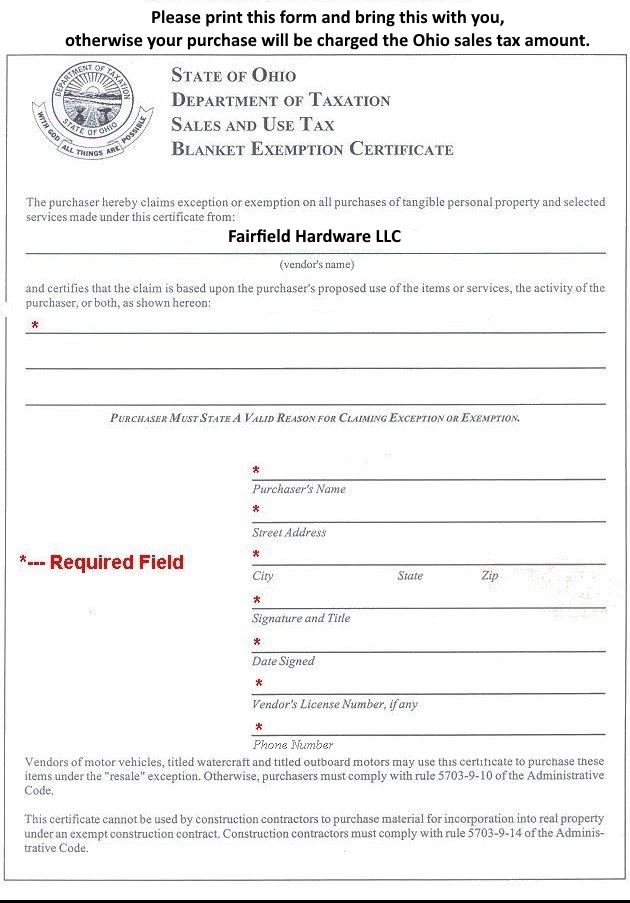

An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one. Offer helpful instructions and related details about Tax Exemption Reasons In Ohio - make it easier for users to find business information than ever. If unsure on whether to claim sales tax exemption this article on Ohio sales tax exemption and reasons to apply is what you need.

Drugs and prescription medical devices sold for human use are also free from sales tax. This represents a significant and important savings that manufacturers shouldnt overlook. Sales of certain items are exempt from sales and use tax.

Sales Tax Exemption Form Ohio information registration support. Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. Ohio State Tax Exemptions Charitable organizations are exempted from sales tax so purchases made by any such nonprofit are not subject to tax.

Vendors and certifies that the claim is based upon the purchasers proposed use of the items or services the activity of the or both as shown hereon.

Word Google Docs Apple Pages Free Premium Templates Contract Template Agreement Free Brochure Template

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

Ohio Resale Certificate Trivantage

Utah Student Loan Forgiveness Programs Student Loan Forgiveness Power Of Attorney Form Student Loans

Arizona Student Loan Forgiveness Programs

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Fairfield Hardware Ohio Tax Exemption Form

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller